Car insurance is something that we must have, but how much do you really know about it? Are you on an auto-renewal plan that you blindly sign every year? Does your plan come with a replacement car? There might be better deals out there, but you don’t know until you actually make a comparison.

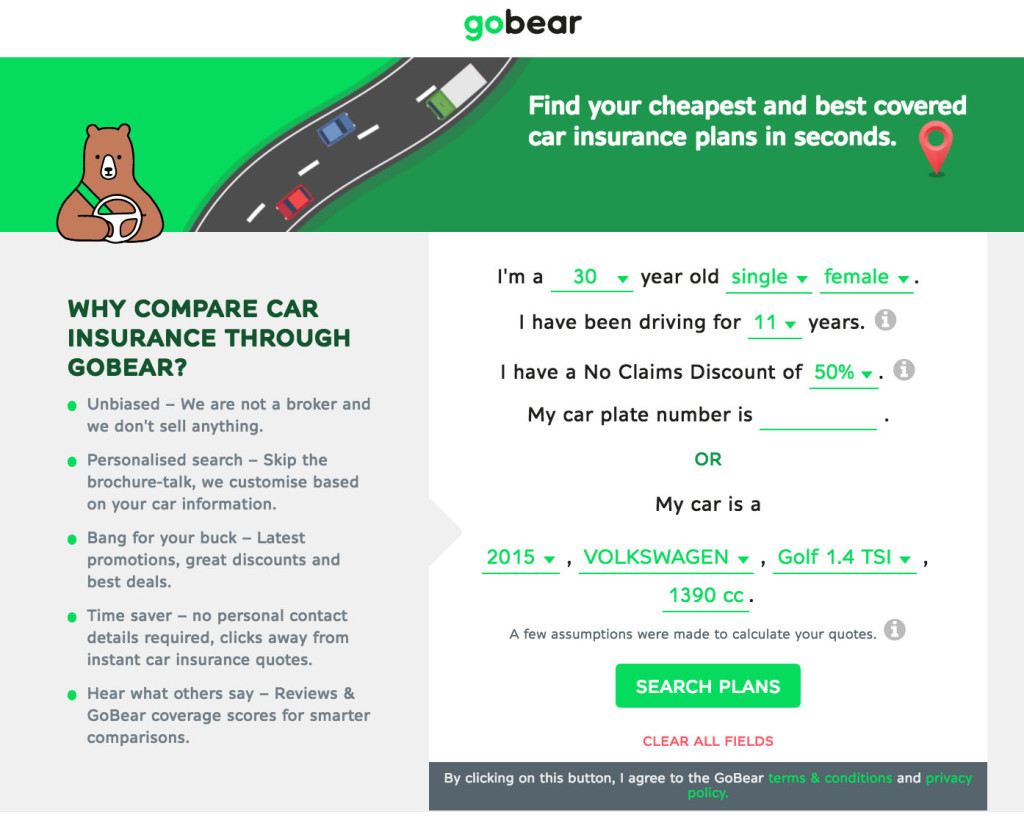

That’s where GoBear, Asia’s first and only metasearch engine in insurance and financial products, comes in useful. Established in Singapore early last year, GoBear helps you to easily compare financial products such as insurance, credit cards and loans.

Let’s take a look at car insurance. The process is very straightforward – you simply key in relevant information and with just a click, you get quotes from a number of insurers.

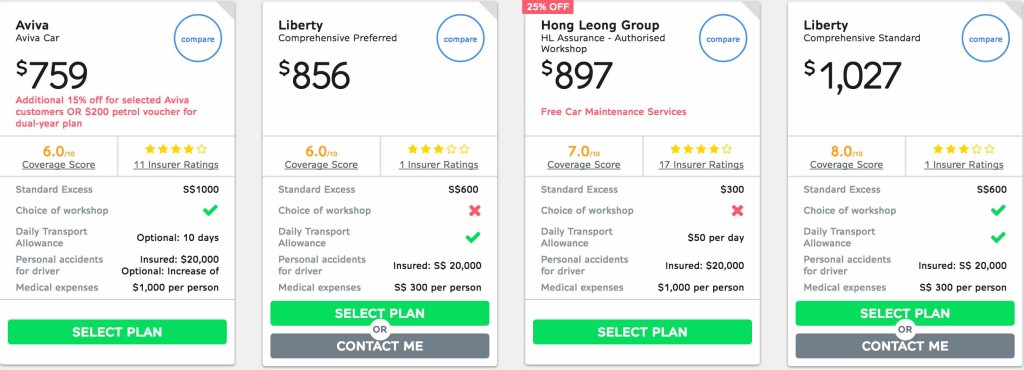

Besides giving a quote, there is also a comparison of other details such as standard excess, daily transport allowance and more. Here is the first row of quotes that came up for me, in ascending order of quotes:

Besides giving a quote, there is also a comparison of other details such as standard excess, daily transport allowance and more. Here is the first row of quotes that came up for me, in ascending order of quotes:

GoBear prides itself on being unbiased and personalised, as they are not selling anything, but purely provides a free and transparent comparison process. They are not manipulated by advertising from service providers either.

Once you decide which quote or plan to go with, you will be directed to the insurer’s website. GoBear does not sell any of the products on their behalf; they only get a small marketing fee from them for any successful referrals.

The website is user-friendly and easy to use, saving me a lot of time. They also have customer reviews which you can take reference from and GoBear has a scoring system to rate the products as well.

To get started, simply go here to get quotes for your car insurance!

While you are at it, I thought you might not mind some tips on how to help you decide on your car insurance better:

1) Customer service is important

It is not uncommon for car owners to take things for granted and overlook the importance of customer service. From my own experience, I didn’t realise how important this was until I got into my first accident. I was panicking and I didn’t know what to do, so I called the insurer for help. Instructions given weren’t very clear and the follow-up was half-baked, to a point I wasn’t sure what was happening with the paperwork and the workshop repairs.

I was initially told the case was in my favour, but it turned out otherwise and I had to pay for damages and lost my NCD amidst other headaches. From that point onwards, I made it sure that my insurer must have good customer service!

2) Watch out for auto-renewal

Auto-renewal is a very common thing – we have it on our Gmail, website domain provider, Spotify Premium accounts, anti-virus subscription etc. It’s alright if you like the service and you want to continue, but if you decide you want to change insurers for your vehicle, remember to opt out of auto-renewal!

That said though, make sure you set reminders if you are not on auto-renewal, so you will know when it’s time to renew your car insurer so it doesn’t expire on you without knowledge. You can start by searching for quotes on GoBear!

3) Take time to understand your policy

Too often, people simply get quotes from different insurers and just go straight for the cheapest. There is a danger in doing that, because you might just be getting the mere basics. Take time to review your policy properly; for example, do you get a replacement car in times of an accident and your car needs to be sent to the workshop?

More useful advice and tips can be found on the GoBear blog. For more information, visit www.gobear.com.sg.

*This post is brought to you by GoBear.